Houston multibillionaire Jeffery Hildebrand has a big problem brewing in Alaska, where one of his Hilcorp Energy companies has presided over two pipeline breaks in the ecologically rich Cook Inlet since December.

After decades of flying under media and public scrutiny, Hildebrand finds his Hilcorp Alaska operation in the limelight. It’s struggling to keep 50-year-old underwater pipelines in the treacherous inlet intact — and at the same time eke out a profit from a depleted oilfield.

It wasn’t supposed to turn out this way.

When he began investing more than $4 billion in Alaska in 2011, oil prices were above $100 a barrel, and Alaska was handing out billions of dollars in subsidies. It was a fat time for oilmen. Now oil prices are hovering near $50, and Alaska’s beginning to slash lucrative tax credits to oil and gas producers, putting a financial squeeze on independent energy producers such as Hildebrand.

When he began investing more than $4 billion in Alaska in 2011, oil prices were above $100 a barrel, and Alaska was handing out billions of dollars in subsidies. It was a fat time for oilmen. Now oil prices are hovering near $50, and Alaska’s beginning to slash lucrative tax credits to oil and gas producers, putting a financial squeeze on independent energy producers such as Hildebrand.

Saddled with a history of negative cash flow and a decrepit infrastructure, Hildebrand’s Hilcorp Alaska is now attracting widespread public criticism and negative press focusing on its Cook Inlet pipeline failures.

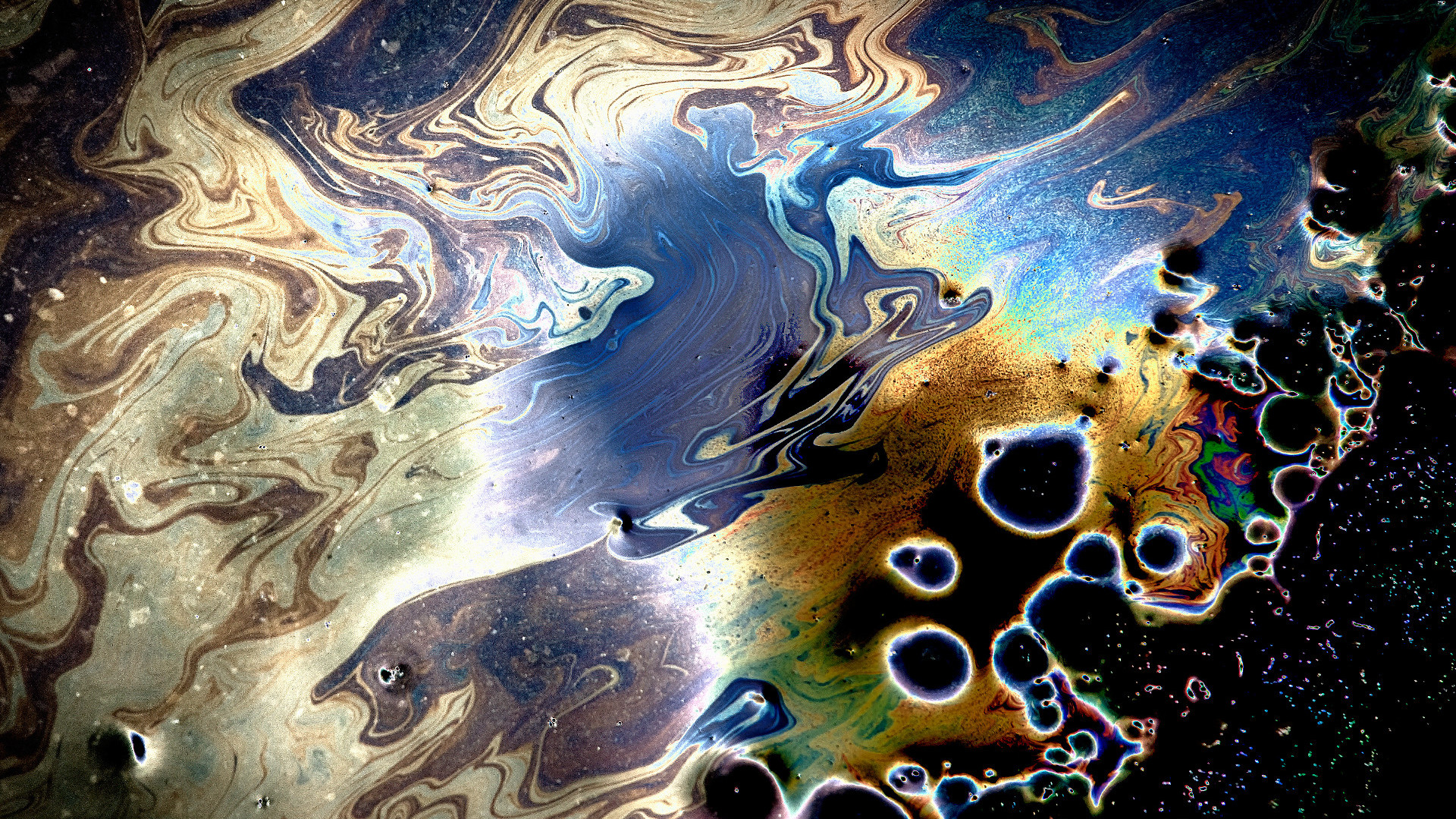

One of the ruptured underwater pipelines released between 200,000 and 300,000 cubic feet methane a day from late December until April 13, posing a threat to the endangered Cook Inlet beluga whale (Delphinapterus leucas) and other marine mammals and fish. The number of beluga whales in the region has declined from 1,300 individuals in 1979 to just 349 in 2014.

“Hilcorp knew when it purchased the (Cook Inlet) property it was buying old infrastructure and did nothing to maintain and inspect it in way that would suggest they were a good neighbor,” says Bob Shavelson, advocacy director for Cook Inletkeeper, a Homer, Alaska environmental group. “They do the bare minimum to wring profits out of here.”

A two-month Revelator investigation of Hildebrand and Hilcorp Energy reveals the 58-year-old petroleum engineer found his way to vast wealth as an energy vulture. Hildebrand became America’s 134th richest person, worth $4 billion according to Forbes (or $9.5 billion/138th richest according to Bloomberg), by rehabilitating played-out oil and gas fields after major energy companies moved on to more lucrative opportunities.

(The Revelator is published by the Center for Biological Diversity, which on Feb. 27 filed a 60-day notice of intent to sue Hilcorp Alaska under the federal Clean Water Act for violations in Alaska.)

Hildebrand deploys a well-paid, highly motivated work force using advanced technology to squeeze out more oil from fields well past their prime. He also emphasizes aggressive cost-cutting that frequently sidesteps environmental and safety regulations, state and federal regulatory records show.

Our investigation shows that Hildebrand is adept at exploiting weak regulatory oversight that is characterized by warnings, forgiveness and slap-on-the-wrist fines. There is little incentive for Hilcorp and other energy producers not to cut corners to save money.

Hildebrand’s rapid-fire investments in the volatile oil and gas industry combined with a damn-the-regulations attitude show just how quickly an energy boom can fizzle and how downward economic pressure can increase threats to the environment and workers’ safety.

A window into Hilcorp’s operations provides a peek into the likely impact of the Trump administration’s “streamlining” and eliminating regulations for energy producers. Regulatory rollbacks have been welcomed on Wall Street, where stocks rose sharply after Trump’s surprise election.

Even before that election, efforts to tighten pipeline regulatory oversite have been stymied for decades by the powerful oil and gas industry, which writes the industry standards for operating and manufacturing pipelines that are then incorporated into federal regulations, says Carl Weimer, executive director of Pipeline Safety Trust, a nonprofit citizen’s group based in Bellingham, Wash., that monitors oil and gas pipeline operations, including Hilcorp’s.

The industry’s fundamental approach, he says is to “put a pipe in the ground, wait for it to fail and then go out and fix it.”

Hilcorp’s flouting of state and federal regulations certainly has not hindered Hildebrand’s ability to raise capital needed to expand his oil, gas and pipeline empire that includes operations in Alaska, Texas, Louisiana, Wyoming, New Mexico, Colorado, Ohio and Pennsylvania.

In fact his attitude is a plus on Wall Street, where it translates into lower costs, higher productivity and a bigger bottom line. This business philosophy has encouraged private equity firms like the Carlyle Group to invest up to $1.24 billion in Hilcorp to acquire, develop and operate onshore oil and natural gas properties in North America.

“We’re thrilled to be partnered with Hilcorp,” said Carlyle’s managing director David Albert of his firm’s December 2015 investment. Carlyle has raised an additional $2.8 billion to invest in privately run energy firms like Hildebrand’s, which have turned to private equity as commercial bank lending tightened after oil prices collapsed in late 2014.

Jeffery Hildebrand & Hilcorp Quick Facts:

-

Courtesy Hilcorp Received a masters degree in petroleum engineering from the University of Texas in 1985.

- Founded Hilcorp in 1989 on the principle of “acquire and exploit.”

- Has donated more than $1.1 million to the Republican Party and Republican candidates in last 10 years including more than $365,000 to former Texas Governor and current Energy Department Secretary Rick Perry and $401,000 to current Texas Governor Greg Abbott.

- Reportedly purchased the late John Denver’s 957-acre Windstar Ranch outside of Aspen, Colo. for $8.5 million.

- Appointed to a six-year term on the Texas Board of Regents by Perry in 2013.

- This past April Hilcorp purchased ConocoPhillips oil and gas holdings in the San Juan Basin for $3 billion.

- Hilcorp has been identified as triggering the first known fracking caused earthquakes in Pennsylvania.

- Hilcorp’s Harvest Pipeline subsidiary owns 240 miles of oil and gas pipelines.

- Hildebrand and his wife, Mindy, operate River Oaks Donuts in the exclusive River Oaks neighborhood in Houston.

Hildebrand also remains a darling in the business press, which hailed him for handing out $100,000 bonuses to most of his employees in December 2015. The $100 million-plus payout was a reward for doubling daily oil production to 150,000 barrels over the previous five years. The big-league bonuses have buffed Hilcorp’s shining star — Fortune has hailed it as one of America’s best companies to work for five years running.

The production-based bonuses may have another purpose. Industry watchdogs caution that Hilcorp’s windfall bonuses can also create a powerful incentive for employees to ignore safety and environmental regulations to facilitate profits and another big bonus.

“One of the things you could get from compensating employees that way is people may be willing to lie for you,” says Carol M. Parker, a New Mexico attorney and former Pipeline Safety Trust board member.

In an emailed response to questions submitted by The Revelator, Hilcorp spokesperson Lori Nelson stated the company “absolutely” does not believe its bonuses provide an incentive to its employees to cut corners and mislead regulators.

“Our company incentives put safety and regulatory compliance above all else,” Nelson stated in a May 10 email: “Hilcorp’s incentives drive a ground up performance delivery of safe and efficient production of domestic energy sources.”

But a pattern of deceiving regulators has apparently played out multiple times. Alaska regulators, exasperated over Hilcorp’s flagrant disregard of safety and environmental regulations, have stated in writing that the company has not been truthful in communications. In Louisiana records show a Hilcorp employee provided false information to federal regulators concerning the destruction of wetlands. (See part III in our series, coming later this week.)

The Alaska Oil and Gas Conservation Commission sharply criticized Hilcorp for its misleading statements. In a Nov. 25, 2015 notice-of-enforcement letter concerning an incident that nearly killed three Hilcorp workers, the commission stated that Hilcorp’s “lack of candor” is “neither isolated nor innocent” since arriving in the state in 2011.

Hilcorp rapidly became one of Alaska’s largest energy companies producing 53,000 barrels of oil and 150 million cubic feet of natural gas per day from about 500 producing wells.

In doing so, Hilcorp became the most frequently cited company in the history of the Alaska Oil and Gas Conservation Commission, with a dozen formal enforcement actions since 2013.

Cashing in on Texas shale, Hildebrand turns to Alaska

Jeffery’s Hildebrand’s biggest payday came from speculating on the Texas Eagle Ford shale oil and gas prospect when oil prices were around $100 a barrel. Hildebrand gained control over 100,000 acres of the Eagle Ford shale belt for about $100 million. The belt extends from the Mexican border in southwest Texas into the middle of southeast Texas.

In June 2010 New York private equity firm KKR invested in Hildebrand’s Eagle Ford holdings through a new partnership called Hilcorp Resources LLC. KKR invested up to $400 million to acquire a 40 percent share of the new partnership.

A year later, with oil still hovering over $100 a barrel, Hilcorp Resources LLC sold its Eagle Ford assets, which had grown to 140,000 acres, to Marathon Oil & Gas for $3.5 billion. Moody’s Investors Services states Hildebrand’s share of the sale was $1.8 billion. Eagle Ford is now one of the nation’s leading oil and gas shale producers.

Flush with cash, Hildebrand turned his focus to Alaska’s Cook Inlet, an ecologically critical body of water extending from Anchorage 180 miles southwest to the Gulf of Alaska. Cook Inlet and the onshore areas surrounding it host the oldest oil and gas production and pipeline facilities in state, most of which were built in the 1960s.

The Cook Inlet Recovery Act enacted by the state legislature in 2010 was a key factor in Hildebrand investing in the state, according to a Hilcorp official’s 2016 testimony before that legislature. The act provided large subsidies to spur oil production that steadily declined to about 9,000 barrels per day from its 230,000 peak in 1970.

Hilcorp seized on what the Alaska Journal of Commerce called “one of the most generous” government subsidy packages in the world featuring hundreds of millions of dollars in refundable tax credits and drilling incentives. The state paid Cook Inlet producers $400 million in refundable tax credits in 2015.

Cook Inlet oil production from all producers totaled only 14,046 barrels per day in February, according to the Alaska Oil and Gas Conservation Commission. (The $400 million subsidy to produce 5,126,790 barrels of oil per year is equal to a $78/barrel subsidy.)

Hildebrand entered the Alaska market in June 2011, when Hilcorp Alaska acquired Chevron subsidiary Union Oil Co.’s production and pipeline facilities in Cook Inlet. At the time the investment appeared to fit nicely with Hildebrand’s operating strategy of purchasing aging oilfields from major oil companies and rehabilitating the production infrastructure.

Hilcorp Alaska expanded its Cook Inlet holdings in late 2012 when it purchased substantially all of Marathon’s oil and gas holdings, giving it control of 70 percent of the natural gas production in Cook Inlet. Together, Hilcorp’s Union Oil and Marathon acquisitions were valued at $879 million.

Over the next two years, Hilcorp Alaska invested an additional $1.2 billion in new drilling and production facility upgrades bringing its total investment in Cook Inlet by 2014 to more than $2.1 billion. The company drilled 50 new wells and now operates 20 oil and gas fields, including 14 offshore platforms. It also operates pipelines, storage facilities and a marine oil terminal.

Revenue from Hilcorp Alaska’s investments, however, has fallen far short of expenses. By the fall of 2014, the company was $600 million in the red, according to the Alaska Journal. Hilcorp’s projections of rapidly ramping up Cook Inlet oil production from 6,000 barrels per day to 25,000 barrels a day by 2014 fell also fell far short reaching only 12,000 to 13,000 barrels in 2015.

Cook Inlet oil production from all producers totaled only 14,046 barrels per day in February, according to the Alaska Oil and Gas Conservation Commission.

“With the track we’re on we still see six or seven years before payout on this, and we think we still need to invest another $1 billion to $2 billion,” Hilcorp Alaska CEO Greg Lalicker told the Alaska Journal in October 2014. His prediction was made before oil completed its dive to $50 and less.

Two years after Hilcorp Alaska began its Cook Inlet operations, Hildebrand invested heavily on the North Slope, where billions of dollars in state subsidies were also being doled out to oil producers.

In April 2014, with oil prices still over $100 a barrel, Hilcorp Alaska spent $1.25 billion to purchase two declining North Slope oilfields and 50 percent interest in two others, including the proposed offshore Liberty Project, from energy giant BP. In a risky move, Hilcorp issued $500 million in unsecured bonds to help finance the BP acquisition.

Hilcorp executed the deal right before it got caught in a major financial squeeze.

Beginning in September 2014, OPEC, led by Saudi Arabia, flooded the market and slashed oil prices in an attempt to wreck the booming U.S. oil shale industry. By January 2015 oil prices had plummeted from triple digits six months earlier to under $50 a barrel.

With Cook Inlet years out from turning a profit, the North Slope projects have only exacerbated Hilcorp’s financial problems in Alaska.

“We have a long ways to go before we’re coming anywhere close to making the money that we hoped to make when we originally made that (North Slope) investment a year and a half ago,” Hilcorp Alaska’s Greg Lalicker said during a luncheon for Alaska legislators in November 2015, according to the Petroleum News, an Anchorage weekly.

Hilcorp spokeswoman Nelson stated the company “can’t speculate on our future returns with our Alaska investments, but we continue to invest in Alaska’s energy future.”

The precipitous decline in oil prices and Hilcorp Alaska’s bleeding red ink coincides with a tsunami of regulatory violations. We’ll examine those in part two of our investigation, appearing tomorrow.

Interesting investigation. How much of Hilcorp’s failure to reach its production projections and to make money is due to softened markets for petroleum products? Is there a track record for how Hildebrande responds to adverse business conditions that could predict what he will do if demand doesn’t rise and he can’t turn a profit?

Some things are FAR MORE priceless left as GOD created them! Destroying, threatening eco systems threatens ALL of us, our planet, our health! Hildebrand is a greedy, heartless man who doesn’t care about future generations, people’s health, wildlife and the wonders of this earth-he only loves money and we know that IS the root of ALL evil!!! SHAMEFUL. DEPLORABLE!!! I HATE “men” like him!!!!!